Our Pag-IBIG MP2 calculator approximates Pag-IBIG MP2’s total accumulated savings value (TASV) for a chosen time period assuming a constant dividend rate on a year-to-year basis.

The calculations presented in this calculator do not guarantee the TASV amount given by Pag-IBIG upon maturity. The MP2 calculation by Pag-IBIG prevails over any calculations made outside of Pag-IBIG.

This investment will be worth -

| Year | Starting Amount | Annual Contribution | Total Contribution | Interest Earned | Total Interest Earned | End Balance |

Definitions

Starting Amount – This is the total amount you will initially invest or have currently invested for the MP2 Savings Program

Additional Contribution – This is the amount you will contribute each period to your investment.

Contribution Frequency – The frequency you will make regular contributions to this investment. We assume that the contribution will occur at the end of the selected contribution period.

Expected Rate of Return – This is the rate of return you expect from your investment in Pag-IBIG MP2. We assume that your rate of return compounds based on the frequency at which you contribute. Please see the historical dividend rates of Pag-IBIG MP2 here.

Years to Grow – This is the number of years you have to save. Please note that Pag-IBIG MP2 has a 5-year maturity. However, you can easily reapply for another MP2 Savings Account when it matures.

Need a Personalized Pag-IBIG MP2 Calculator?

If you’re looking for a calculator that you can more easily customize based on your own inputs, then you might need a Personalized Pag-IBIG MP2 Calculator.

With the calculator linked above, you can easily simulate your own personal investment strategies. This will allow you to determine the best way for you to invest your money in Pag-IBIG MP2.

You will also be able to visualize how you can use Pag-IBIG MP2 to build your retirement fund and financial goals.

What computations can you do with it?

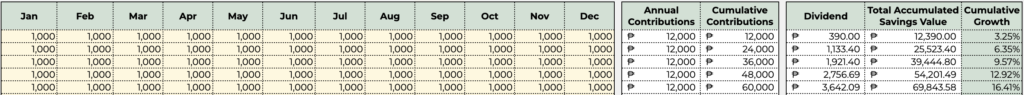

- Fixed Monthly Contributions

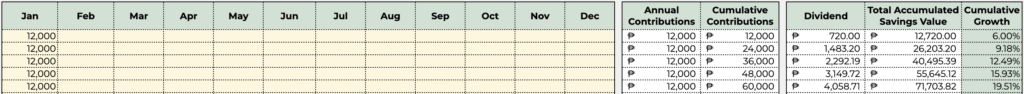

- Annual Contributions

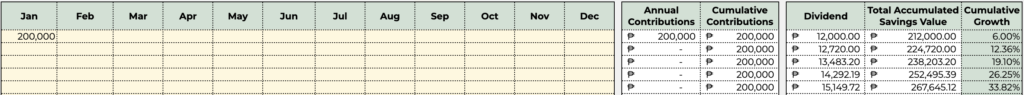

- One-Time Contribution

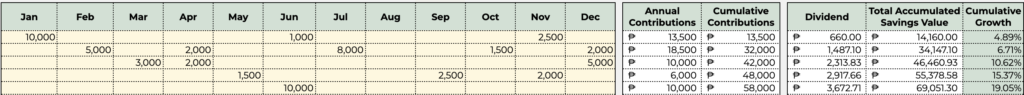

- Irregular Contributions

If you’re interested in getting a Personalized Pag-IBIG MP2 Calculator, then check it out through this link here.

Frequently Asked Questions

We have compiled a list of the most commonly asked questions about the Pag-IBIG MP2 Savings Program which might help you better understand how it works and to help you make a decision on whether or not you should invest.

1. What is the Pag-IBIG MP2?

The MP2 Savings Program is a voluntary savings program with a 5-year maturity designed for Pag-IBIG members who wish to save more and earn higher dividends than the regular Pag-IBIG Regular Savings Program.

2. Who can save under the Program?

The Program is open to active Pag-IBIG Fund members.

In addition, it is also open to:

- Former Pag-IBIG Fund members (pensioners and retirees) with other sources of monthly income, regardless of age, and with at least 24 monthly savings prior to retirement.

- Natural Born Filipinos, who reacquired their Filipino Citizenship pursuant to RA 9225 or the Citizenship Retention and Reacquisition Act of 2003, with at least 24 monthly savings prior to permanent migration to another country.

3. What is the interest rate of MP2 in Pag-IBIG in 2022?

The Pag-IBIG MP2 dividend rate for 2022 will only be determined by the end of the year as the amount of dividends that Pag-IBIG can declare is based on their annual net income.

With that said, here are the historical dividend rates of the Pag-IBIG MP2 Savings Program since 2011:

| Year | MP2 Savings Dividend Rate |

|---|---|

| 2021 | 6.00% |

| 2020 | 6.12% |

| 2019 | 7.23% |

| 2018 | 7.41% |

| 2017 | 8.11% |

| 2016 | 7.43% |

| 2015 | 5.34% |

| 2014 | 4.69% |

| 2013 | 4.58% |

| 2012 | 4.67% |

| 2011 | 4.63% |

4. How much should I contribute to MP2?

There is a minimum contribution amount of Php 500 per remittance while there is no limit as to how much you can invest in the MP2 Savings Program.

However, should you make a one-time deposit that exceeds Php 500,000, you shall be required to make such remittance via personal or Manager’s Check.

In addition, you shall also be required to submit proof of income or source/s of funds if you invest more than Php 100,000 in your MP2 Savings Account.

5. Can I pay Pag-IBIG MP2 twice a month?

Yes, you can. You can save anytime you want, whether it’s weekly, twice a month, monthly, annually, or a one-time lump sum deposit.

However, if you want to maximize your MP2 Savings, you will earn a higher overall return if you deposit Php 100,000 all in one go compared to splitting it into multiple deposits over a certain time period.

This is primarily due to the power of compound interest.

6. What will happen to MP2 after 5 years?

Once your MP2 Savings reach maturity after 5 years, you will now be able to freely claim and withdraw your savings from Pag-IBIG MP2. You can then re-apply for a new MP2 Savings Account to continue earning dividends at the MP2 Savings Rate.

If you do not claim your MP2 Savings after the 5-year maturity, it will then stop earning dividends under the MP2 Savings rate. However, it will keep earnings based on the dividend rate of the Pag-IBIG Regular Savings for the next 2 years if it is not claimed. After this time period, your account will then stop earning any type of dividend.

7. Can I withdraw my MP2 before 5 years?

Yes, Pag-IBIG allows for the pre-termination and full withdrawal of your MP2 Savings before the 5-year maturity period based on the following reasons:

• Total disability or insanity

• Separation from service by reason of health

• Death of the member or of any of his/her immediate family member

• Retirement (except when the MP2 Saver is already a retiree)

• Permanent departure from the country

• Distressed member due to unemployment limited to layoff and/or closure of the company

• Critical illness of the member or any of his immediate family members, as certified by a licensed physician,

subject to the approval of Pag-IBIG Fund

• Repatriation of an Overseas Filipino Worker (OFW) member from the host country

• Other meritorious grounds as may be approved by the Pag-IBIG Fund

A member who opts for compounding of MP2 Dividends and later decides to pre-terminate his/her MP2 Savings for reasons other than the circumstances stated above shall only be entitled to 50% of the total dividends earned.

A member who opts for an annual MP2 Dividend payout and later pre-terminates his/her MP2 Savings for reasons other than those stated above shall only receive his/her total savings.

9. What if I stop paying my MP2?

The Pag-IBIG MP2 is a voluntary savings program. Therefore, you are not obligated by Pag-IBIG to regularly deposit money into your account.

Even if you stop contributing to your MP2 Savings account, you will still continue to earn dividends until the 5-year maturity. There is no penalty for not adding funds on top of your initial contribution. You are free to deposit as much or as little as you want with no penalties.